Atr Trailing Stop Pdf

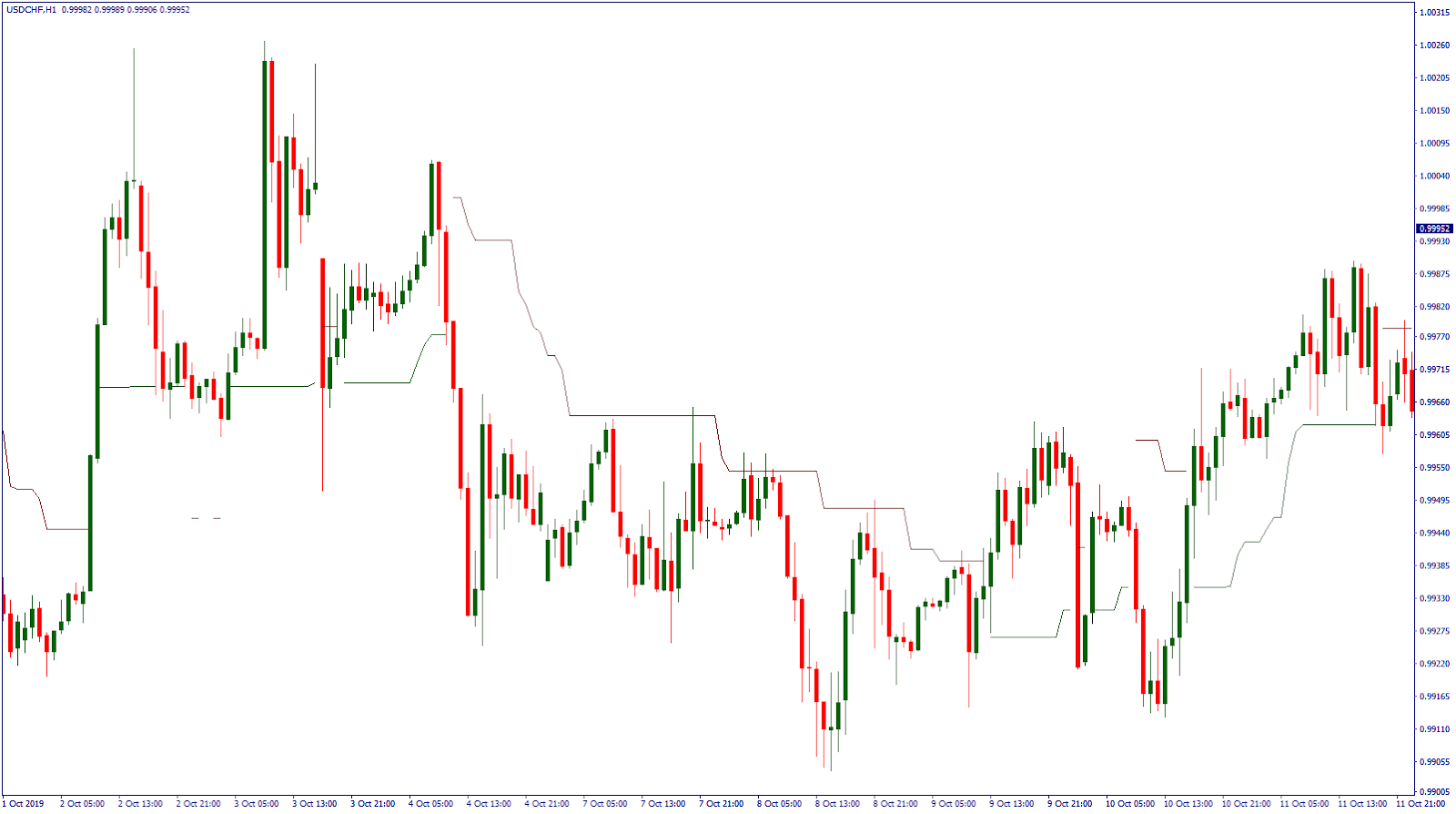

An ATR trailing stop is one way to manage a trade at both the time of entry as a stop loss setting and if it evolves into a winning trade by exiting when the price reverses far enough to trigger a trailing stop exit.

This type of trailing stop uses the technical indicator of the Average True Range which is a measure of the magnitude of current price volatility, it is a moving signal and expands as the trading range grows and contracts as the trading range gets smaller.

:max_bytes(150000):strip_icc()/dotdash_final_A_Logical_Method_of_Stop_Placement_Dec_2020-01-14766bb7ef8046b4a594e1f825d2f602.jpg)

The average true range is commonly used for setting a stop loss and also trailing a stop loss. One strategy for using the ATR to set your stop loss is using a multiple of the average true range. For example; you may set your stop 2 x the ATR away from the current price. Hello, friends, today video concept is ATR Trailing Stop (Stop loss) indicator for simple & easy trading. This indicator very useful for beginners and exper.

This process is based on the fact that the ATR is a measurement of the average volatility of the price action in a set time period. This is a mechanical trailing stop and is quantified taking away the psychological pressure of discretionary decision making about where to set an initial stop-loss at entry and where to exit a winning trade based on a trailing stop.

Figure 1: average true range trailing stop. Here you see a chart of AMD with a 14% fixed closing price trailing stop (red) and a 3.5 times five-day ATR average (blue).

The Average True Range technical reading is calculated with the daily price range change and uses the greatest of three possible readings: ‘high minus the previous close’, ‘previous close minus the low’ or the ‘high minus the low’. For an ATR trailing stop the 21-day period average ATR is commonly used. A multiple of 3 is plotted with the ATR on the chart as a visual trailing stop to use for signaling in most cases.

In the case of a long position the 3 ATR would be trailing below the price on the chart in the case of a short position the 3 ATR would be trailing above the price.

The ATR is a moving indicator and changes with the degree of volatility in price action. It will be wider range in highly volatile charts and tighter in less volatile charts. A 2 ATR trailing stop can be used in extremely volatile markets to lower the risk of the distance to the stop loss or trailing stop.

Using an ATR trailing stop starts at entry, if price gets lower than 3 ATRs away from your entry price you exit for a loss at that technical level. If your trade is a winner then you exit the winning trade when price reverses lower than 3 ATRs.

Using an ATR trailing stop is a type of trend following system that allows your winners to run and cuts your losses short while also giving room for a trade to work out without a premature exit.

The ATR trailing stop is a risk management tool and exit signal used after an entry signal is taken and not a signal to buy.

Atr Trailing Stop Pdf Merge

This is a mechanical way to manage your trade exits.

Chart Courtesy of TrendSpider.com

Update: For those who want to manually backtest this indicator, check this tool https://www.mql5.com/en/market/product/59248

Atr Trailing Stop Thinkorswim

The indicator will help make your calculation of stop loss easier as it will be visually aiding you in choosing where to put your stoploss level on the chart by calculating the current value of ATR indicator.

Atr Trailing Stop Settings

For those who are unfamiliar with ATR, it is a useful indicator to calculate stoploss for trend following strategy. If volatility is high, ATR stoploss level will be wider to ensure that your stoploss is reasonably wide enough to stay with the trend; and when volatility is low, ATR stoploss level will be contracted narrower to ensure that you won't be caught in a sudden trend reversal or big pullback.

Note: This indicator will not modify your trade order, it only helps you visually by drawing a line! So please remember to manually modify your order.

/ATR1-5a171ba20d327a003786731b.jpg)

Parameter:

- DRAW_ATR_TRAILING_STOP_LEVEL_TIMEFRAME = PERIOD_H4; //timeframe to calculate the value of ATR

- DRAW_ATR_TRAILING_STOP_LEVEL_PERIOD = 10; //period of the ATR

- DRAW_ATR_TRAILING_STOP_LEVEL_MULTIPLIER = 1.5; //a higer value means a bigger stop loss for those who want to ride bigger trend

- DRAW_ATR_TRAILING_STOP_LEVEL_COLOR = clrRed; //color of the ATR level when drawn on chart

- DRAW_ATR_TRAILING_STOP_LEVEL_THICKNESS = 10; //if the ATR level line is too small, you may adjust (value is different for different broker and symbols)